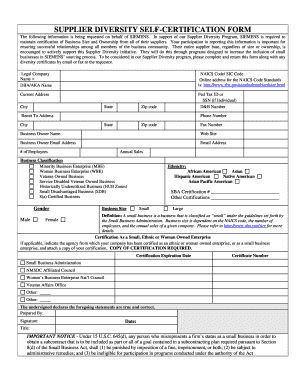

Get the free self certification statement form

Get, Create, Make and Sign

How to edit self certification statement online

How to fill out self certification statement form

How to fill out tax filing online:

Who needs tax filing online:

Video instructions and help with filling out and completing self certification statement

Instructions and Help about tax online form

Small disadvantaged businesses what you need to know a small disadvantaged business SUB is a small business that disowned by one or more individuals who are both socially and economically disadvantaged SUB status makes a company eligible for bidding and contracting benefit programs involved with federal procurement the Small BusinessAdministration SBA defines socially disadvantaged groups as those who have been historically subjected to racial or ethnic prejudice or cultural bias within the larger American culture identified groups include African Americans Asian Pacific Americans Hispanic AmericansNative Americans and subcontinent Asian Americans members of other groups may qualify if they can satisfactorily demonstrate that they meet established criteria economically disadvantaged individuals are defined as those for whom impaired access to financial opportunities has hampered the ability to compete in the free enterprise systemic contrast to people in similar businesses who are not identified as socially disadvantaged originally businesses had to be certified by the SBA to qualify for SD B status since October 2008 companies have been able to self certify you do not have to submit an application to SBA for SD B status program eligibility to self represent San SDP register your business in the system for award management your firm must be small according to SBA standards be at least 51% owned and controlled bone or more disadvantaged persons whore socially disadvantaged and economically disadvantaged while SBA must still certify all firms that participate in the 8a business development program the requirements to be approved are different and more rigorous than sub only status we ate a business development program ISA business assistance program for small disadvantaged businesses it provides managerial technical and contractual assistance to small disadvantaged businesses to ready the firm and its owners for success in industry the program is also an essential instrument for helping socially and economically disadvantaged entrepreneurs gain access to a wider set of buyers partners and contracts present in mainstream American markets the program helps thousands of aspiring entrepreneurs to gain a foothold in government contracting participation in the program is divided into two phases over nine years a four-yeardevelopmental stage and a five-yeartransition stage the overall program goal is to graduate 8 a firms that will go on to thrive in a competitive business environment benefits of the program participants can receive sole source contracts up to a ceiling of 4million dollars for goods and service sand 6.5 million dollars for manufacturing while the Small BusinessAdministration helps 8 a firms build their competitive in institutionalknow-how it also encourages firms to participate in competitive acquisitions8 a firm are also able to form joint ventures and teams to bid on contracts this enhances the ability of 8 a firms to perform larger...

Fill business self certification declaration : Try Risk Free

People Also Ask about self certification statement

Our user reviews speak for themselves

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Fill out your self certification statement form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.